Dubai's TECOM Group has debuted on the Dubai Financial Market (DFM) successfully.

The IPO was 21 times oversubscribed with total gross demand surpassing AED 35.4 billion.

The final offer price was set at AED 2.67 per share, giving it a valuation of AED 13.4 billion.

Speaking exclusively to ARN News, Abdulla Belhoul, CEO of Tecom Group says it's an important milestone for Dubai and the group, and gave details of the demand for the share offering.

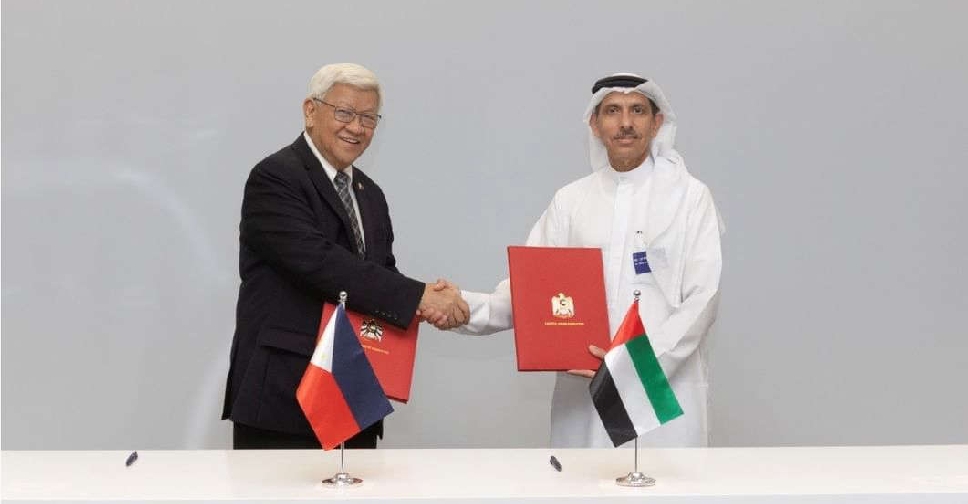

UAE, Philippines agree on additional flight rights

UAE, Philippines agree on additional flight rights

Dubai launches nationwide campaign to combat economic fraud

Dubai launches nationwide campaign to combat economic fraud

DP World launches 36-hour Dubai-Iraq sea link

DP World launches 36-hour Dubai-Iraq sea link

Parkin expands into Abu Dhabi under partnership with DAMAC

Parkin expands into Abu Dhabi under partnership with DAMAC

Dubai hosts Sustainable Bio International Forum

Dubai hosts Sustainable Bio International Forum