The UAE's Federal Tax Authority (FTA) confirmed that it is now receiving refund applications from business visitors who came to the country in 2018.

An application form is available on their website along with a guide to the procedure.

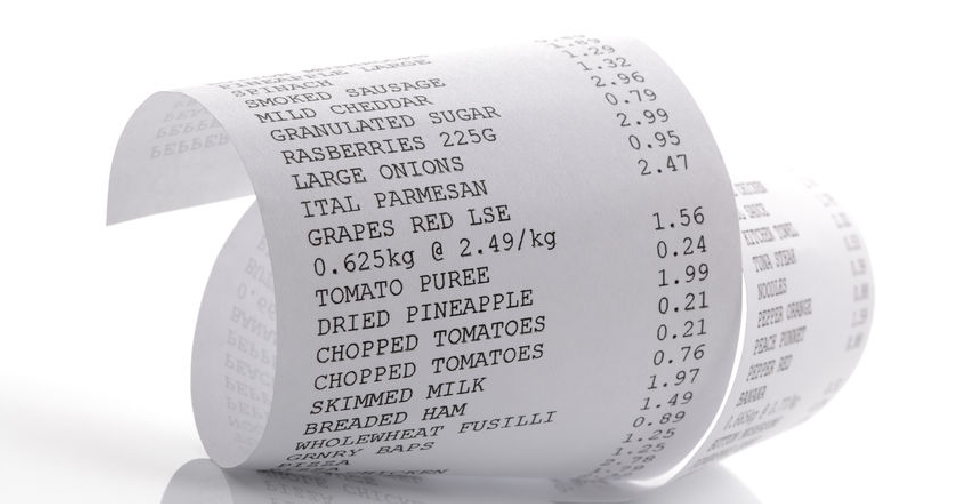

The FTA clarifies that the minimum amount of each application is AED 2,000 which can consist of either a single receipt or multiple ones.

The period of each refund claim is a calendar year. While the authority began accepting refunds for 2018 on April 1, the opening date for subsequent years will be March 1.

Business visitors are urged to hold on to the original tax invoices as they would have to submit them along with their applications in order to claim their refunds.

New York Times reporter sues Google, xAI, OpenAI over chatbot training

New York Times reporter sues Google, xAI, OpenAI over chatbot training

New Zealand concludes FTA with India with aim to double trade

New Zealand concludes FTA with India with aim to double trade

Mubadala partners with Actis to invest over $350 million in Rezolv Energy

Mubadala partners with Actis to invest over $350 million in Rezolv Energy

World Bank approves $700 million for Pakistan's economic stability

World Bank approves $700 million for Pakistan's economic stability

China's ByteDance signs deal to form joint venture to operate TikTok US app

China's ByteDance signs deal to form joint venture to operate TikTok US app